- Massive Plant in GA

- Aims to boost production by 70%

- Avoid 25% Tariffs

- Push 80% of cars in USA

- Plant in GA 350k cars

- Plant in AL 400k cars

Hyundai and Kia Increase U.S. Production to Counter Trump’s Proposed 25% Auto Tariff

Automakers Seek to Mitigate Impact of Potential Tariffs

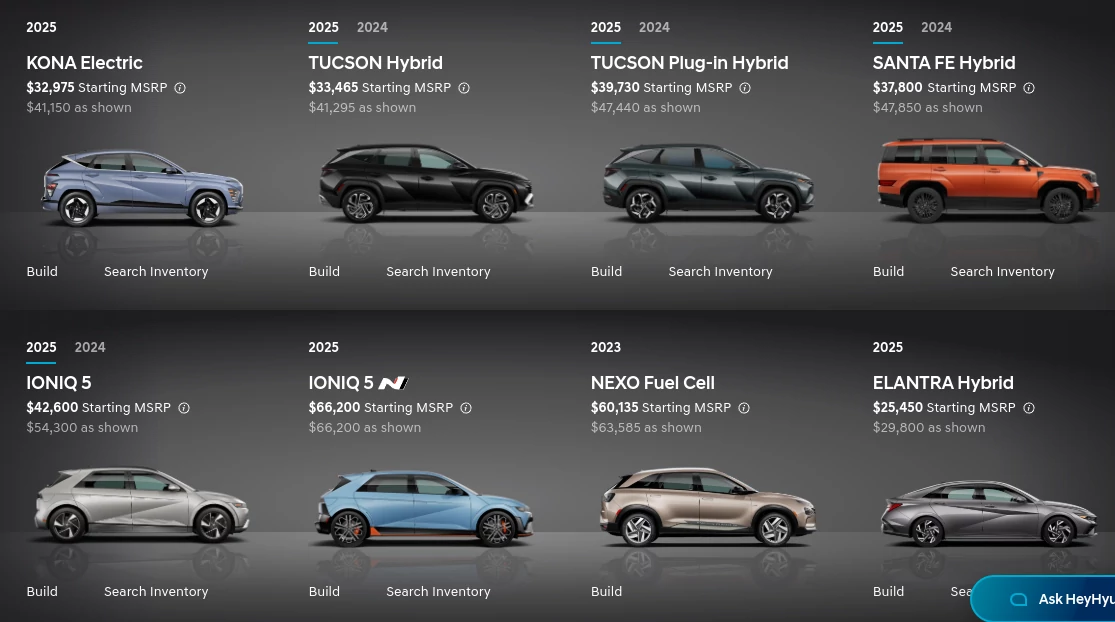

Hyundai Motor Company and Kia are ramping up domestic automobile production in the United States to counter President Donald Trump’s proposed 25% tariff on auto imports, according to a recent report.

On Tuesday, Trump stated that imported automobiles could face tariffs “in the neighborhood of 25%,” with further details expected in early April. However, he reassured manufacturers that they would be given time to adjust before the tariff is implemented.

“If they have a plant and factory here, there will be no tariff,” the 47th president remarked.

In response, Hyundai and Kia plan to increase their U.S. vehicle production by 70% utilizing their massive new plant in Georgia, which is scheduled to begin operations in March.

Hyundai’s Strategy to Localize Production

When asked in January how Hyundai would respond to Trump’s proposed auto tariffs, Koo Za-yoong, executive vice president of investor relations at Hyundai, emphasized the company’s long-term commitment to localizing production:

“It may take some time, but our ultimate goal is localizing production to minimize the influence of the tariff threat.”

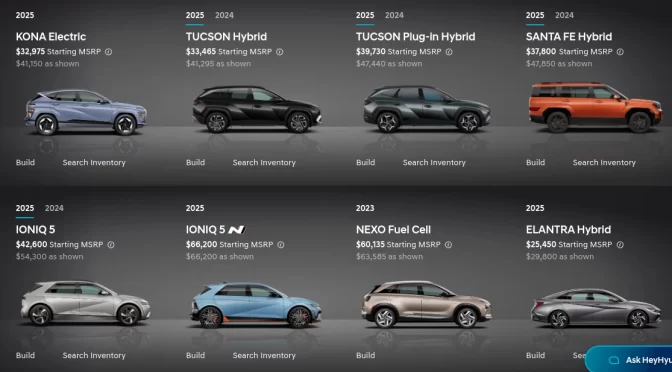

He further elaborated that Hyundai’s Alabama plant, which has a production capacity of 400,000 vehicles per year, combined with the upcoming Georgia plant, which will add 350,000 units of capacity, would allow the company to cover up to 80% of U.S. sales through domestic production.

“If the tariff issue is realized, Hyundai can cover up to 80% of U.S. sales with U.S. production for now,” Koo added.

The Economic Impact on South Korea’s Auto Industry

South Korea relies heavily on automobile exports, with vehicles comprising 27.2% of the country’s total exports, amounting to $34.74 billion in 2024.

According to a report from the IBK Economic Research Institute, a 25% tariff on foreign automobiles would significantly reduce South Korea’s auto exports to the U.S., potentially dropping them by 18.6%.

Korea JoongAng Daily reported:

“KB Securities also said in a report that if Trump minimizes the rate to 10%, Hyundai Motor and Kia will suffer at least a 4.3 trillion won cut in operating profit. By simple calculation, with 25% tariffs, that influence could reach some 10 trillion won.”

Kia Considers Alternative Markets and Supply Chain Adjustments

Kia, which operates a manufacturing plant in Mexico, is now exploring supply chain adjustments to avoid heavy tariffs on Mexican imports. One option under consideration is shifting vehicle exports to Canada, where no tariffs exist between the two countries.

Trump has previously implemented 25% tariffs on all products coming from Mexico, raising concerns for automakers that rely on Mexican manufacturing.

“Hyundai can offer the expansion of U.S. capacity as a bargaining chip on the negotiating table with Trump,” said Lee Hang-gu, a researcher at Automotive Intelligence, a consulting firm.

“But ramping up capacity means more investment. Hyundai has already invested much, and it is Trump’s tall order for it to do more.”

Japanese Automakers Also Preparing for Potential Tariffs

The proposed tariffs could also have far-reaching effects on Japanese automakers exporting vehicles to the U.S. Makoto Uchida, an executive from a major Japanese automaker, acknowledged the potential consequences:

“From Mexico to the U.S., we are exporting a significant number of cars this fiscal year. […] 320,000 units are exported from Mexico to the U.S., and if the high tariffs are imposed, we need to be ready for this.

“Maybe we can transfer the production of these models elsewhere. If this is the decision, we will think about how we can make it a reality while monitoring the situation carefully,” Uchida stated.

He further emphasized the importance of U.S. exports for Japanese manufacturers:

“We are exporting a large volume to the U.S., so if there’s a high tariff, this would have huge implications on our business. We need to monitor this carefully.”

What’s Next?

With Trump’s tariff announcement expected in early April, automakers like Hyundai, Kia, and other foreign manufacturers must re-evaluate their production and supply chain strategies to mitigate financial risks.

The opening of Hyundai and Kia’s Georgia plant in March will play a pivotal role in helping the companies increase U.S. production and minimize tariff exposure. Meanwhile, companies with heavy reliance on Mexican manufacturing may have to explore alternative production strategies, such as relocating production to the U.S. or Canada.

More details on Trump’s auto tariff policy will emerge in the coming weeks, shaping the future of the automotive industry’s global supply chain.

Sources:

- Hyundai Motor Company and Kia (same Company) https://www.hyundaiusa.com/us/en

- President Donald Trump

- Korea JoongAng Daily

- Makoto Uchida

#featured #bridgenewzcom #bridgenewz #breakingnews #breaking #news #businessnews #jobs #growth #trump #president #tariffs #hyundai #kia

Author Ryan Bridglal, 03/11/2025